📋 KEY POINTS

-

- 🎯 The Goal: Get a degree without mortgaging your future.

- 💰 The Strategy: Prioritize “free money” (grants/scholarships) over loans.

- 📝 The Rule: Always file the FAFSA early—it’s the key to unlocking aid, even if you think your parents make too much money.

- 👀 The Reality Check: Don’t just look at tuition; look at the full “Cost of Attendance” (housing, food, books).

- ⚠️ The Trap: Loans should be a last resort. Borrow only what you strictly need, not what you are offered.

- 💸 The Reality: Average student loan payment: $490/month — for 10+ years.

👆 Download the complete guide with cost charts & checklists

Introduction: Don’t Let the Price Tag Scare You

Whether you’re choosing your first college, considering a transfer, or rethinking your financial aid package, the question is the same: “How am I going to pay for this?” The stress is real.

But here is the good news: You don’t have to figure it out alone, and you definitely don’t have to go broke. The secret is understanding the game before you start playing.

“The key is knowing how to get the most aid without having to pay it all back later.”

— George Snow Scholarship Fund

1. Know What You’re Actually Paying For

Before you fall in love with a campus, you need to look at the price tag—the real one.

The “Sticker Price” vs. Reality

Most students only look at tuition. That’s a mistake. You need to look at the Cost of Attendance (COA). The COA includes:

- Tuition & Fees

- Housing and Food (Room & Board)

- Books, Supplies, and Transportation

- Personal Expenses (laundry, toiletries, etc.)

The Three Tiers of Cost

🟢 In-State Public Schools

Usually your wallet’s best friend. Governments subsidize these, making them the most budget-friendly option.

🟡 Out-of-State Public Schools

Expect to pay two to three times more than in-state students.

🔴 Private Universities

Often have the highest sticker price, though they may offer aid to lower the cost.

“Remember, the most expensive option isn’t always the best option – many affordable schools offer excellent education and opportunities.”

— George Snow Scholarship Fund

2. The “Free Money” Hierarchy

When filling your financial bucket, always go in this order:

Step 1: Grants (The Best Kind of Money) 💚

These are usually need-based and come from the government. You do not have to pay them back.

Step 2: Scholarships (The Hustle) 💙

This is free money based on merit, talent, or need. Apply for everything—external scholarships from community groups and institutional scholarships from the colleges themselves.

Step 3: Loans (The Last Resort) ❤️

Loans must be repaid with interest. If you must borrow, always choose Federal Student Loans first. They have lower interest rates and more flexible repayment options than private loans from banks.

3. The Golden Ticket: FAFSA

You cannot ghost the FAFSA (Free Application for Federal Student Aid). It is critical.

Why? It determines your eligibility for grants, federal loans, and many school-specific scholarships.

When? Submit it ASAP. Many aid programs are “first-come, first-served”.

🔥 Myth Buster: Think your parents make too much money? Apply anyway. The formula considers family size and other factors—don’t self-reject!

4. The Debt Trap (And How to Avoid It)

⚠️ Student loans are no joke.

In the U.S., there is currently $1.74 Trillion in student loan debt—that’s 1.5x more than credit card debt. Carrying heavy debt can delay major life milestones, like moving out of your parents’ house, buying a car, or starting a family.

How to stay safe:

- Align your college choice with your career salary. Don’t take on $100k in debt for a career that starts at $35k/year.

- Only borrow what you need. Just because a lender offers you $20,000 doesn’t mean you should take it all if you only need $10,000.

Your Future Self Will Thank You

Taking control of your finances now might feel like homework, but it’s actually self-care.

“By taking charge now, you’ll be giving your future self the gift of freedom—freedom to start a career, travel, or pursue passions without worrying about paying off massive student loans.”

— George Snow Scholarship Fund

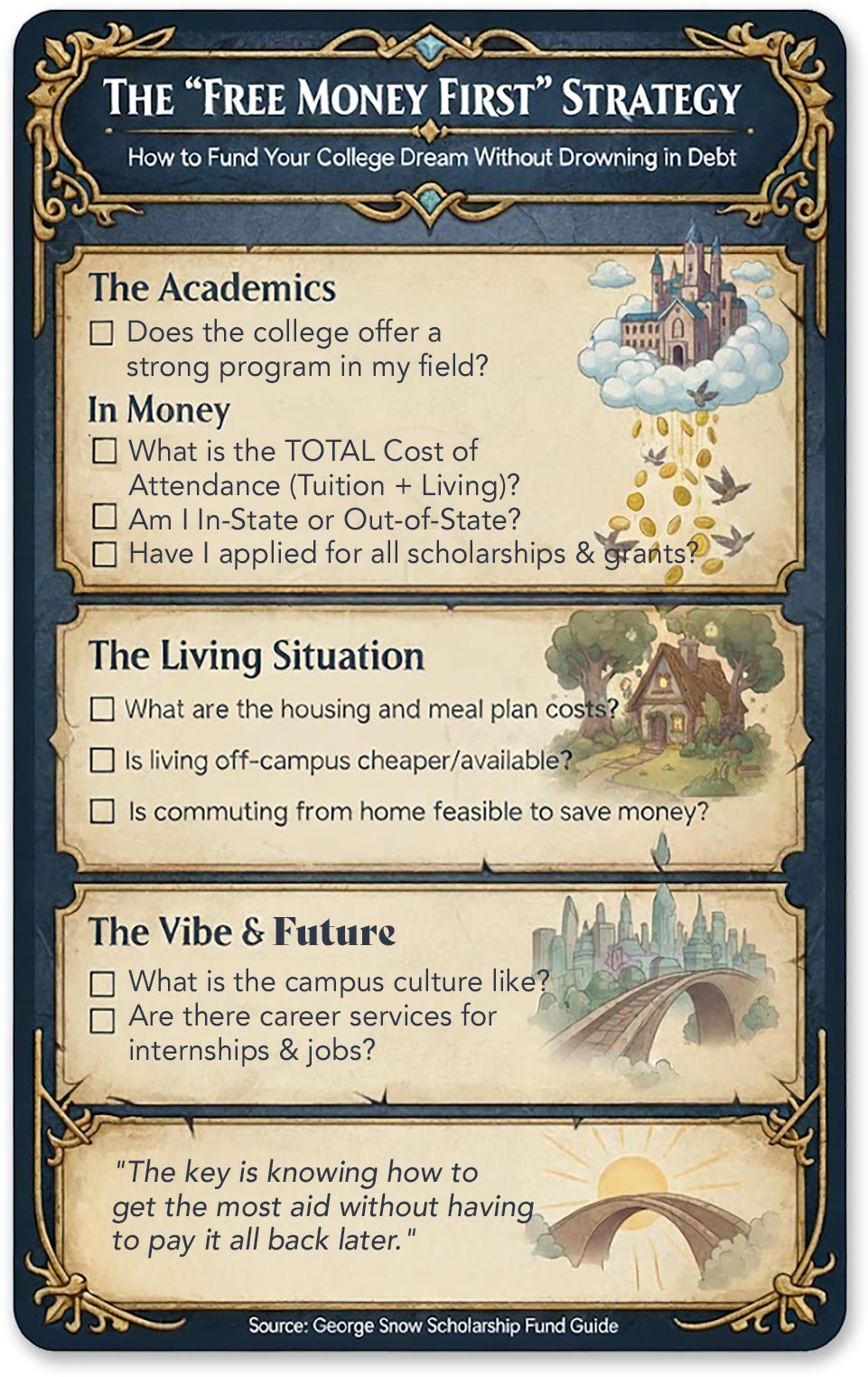

📋 The “Am I Ready?” Checklist

Screenshot this or download it to your phone for quick reference!

YOUR COLLEGE DECISION CHECKLIST

📚 The Academics

💰 The Money

🏠 The Living Situation

🎯 The Vibe & Future

🚀 Next Step

Have you filed your FAFSA yet? If not, that is your homework for tonight. If you have, start researching the specific “Cost of Attendance” page on your dream school’s website!

Material adapted from George Snow Scholarship Fund Guide by permission.